However, shareholders still earn the interest from loaning their shares to short sellers. Borrows and LocatesĪt this time, Robinhood does not offer short selling. Additionally, like many discount brokers, Robinhood makes revenue by selling your order flow, or in other words, allowing high-frequency traders first access to your order. It is safe to assume that of all discount brokers, Robinhood likely has the worst executions because of the lack of commissions. Robinhood has no direct market access available, hence, choosing which route to send your order through isn’t a choice. Executions, Routes, Borrows, and Locates Routes

ROBINHOOD APP CUSTOMER SERVICE FREE

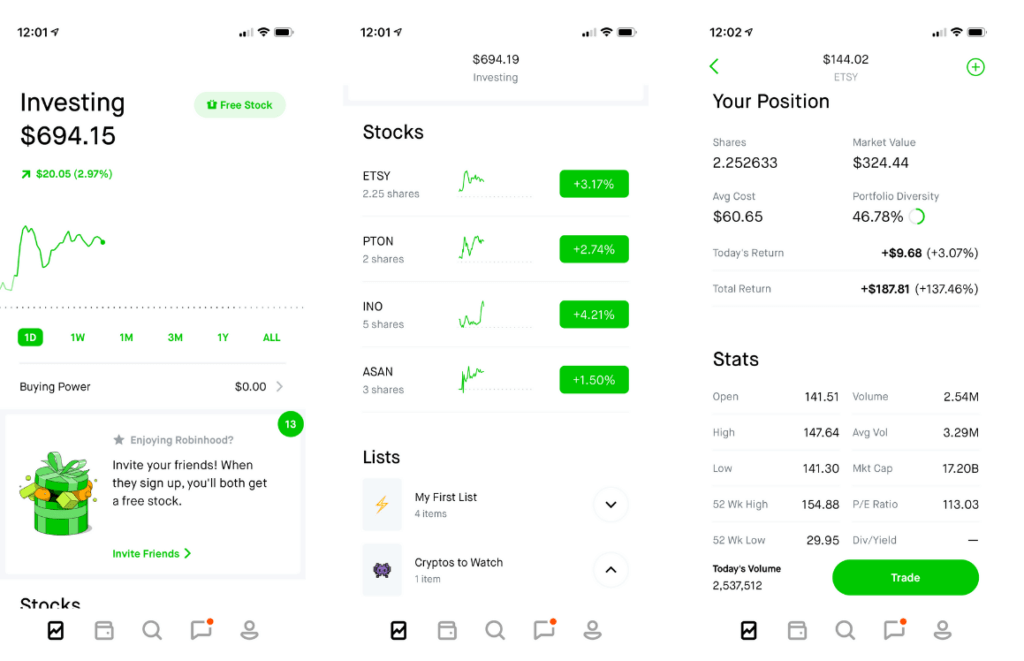

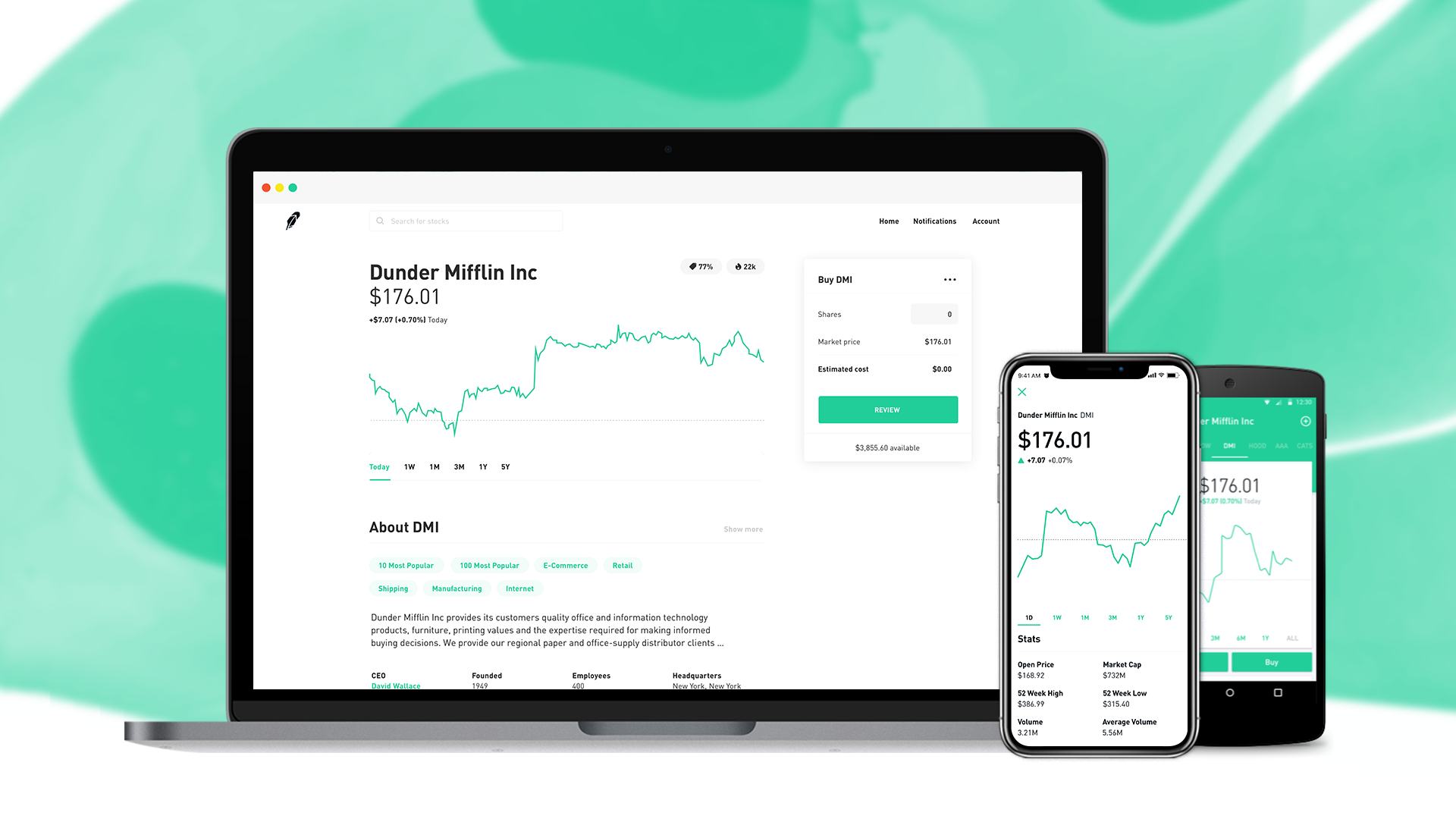

Most users of the app see the poor service as a necessary evil to attain free commissions. Robinhood is infamous for their poor customer service. Users of Thinkorswim and other sophisticated platforms shouldn’t hold their breath. There are only screenshots available, but it looks similar to the web app. Robinhood currently has a waiting list for their upcoming web platform, Robinhood for Web. For unsatisfied traders, it is recommended to subscribe to a secondary trading platform to perform their analysis. However, Robinhood still claims their margin fees are cheaper than the big box brokerage firms, the following infographic is from their About page.Ĭurrently, Robinhood offers one trading platform, their smartphone app, with zero fees. It has very limited analytics, not enough to satisfy most traders and investors. Additionally, the margin is only limited to 2x your buying power, as opposed to most broker’s 4x margin, and 6x intraday margin, which does not require a membership fee (although interest is charged). This service is called Robinhood Gold, and the monthly fee depends on your account size. Trading RestrictionsĪs an alternative business model, Robinhood charges a monthly fee to access margin. Robinhood currently charges no commissions for trading. Robinhood has no account minimums, you can start investing with as little as $0.10, and with no commissions, you can trade penny stocks with loose change. we are able to maintain a lean bottom-line and pass the savings along to you, the customer.” Account Minimums

ROBINHOOD APP CUSTOMER SERVICE MANUAL

By cutting out the fat - hundreds of storefront locations, manual account management, expensive Super Bowl ads, etc. “How are we able to offer commission-free trading while others charge up to $10 per trade? Robinhood was built from the ground up to be as efficient as possible. Here is an excerpt from their About page on the website. Robinhood claims their ability to offer free commissions is due to their lean spending. The firm has executed over $30 billion in trades as of 2017. Robinhood launched as a waiting list, and after a month, had 100,000 members on their list. As HFTs, they realized commission-free trading is possible, and they aimed to bring it to the individual investor. Opened in 2013, Robinhood was founded by former high-frequency traders and Stanford graduates Vlad Tenev and Baiju Bhatt.

6 Executions, Routes, Borrows, and Locates.

0 kommentar(er)

0 kommentar(er)